Households taking out new mortgages in Heywood and Middleton North are seeing lower costs, as typical interest rates have dropped below 4% for the first time in more than two years.

New figures show that the average rate on a two-year fixed mortgage with a 75% loan-to-value ratio fell from 5.16% in June 2024 to 3.97% in December 2025. The change has led to estimated monthly savings of around £115 for new borrowers.

Analysis based on a representative mortgage on a £215,000 home, the median price in Heywood and Middleton North, suggests new buyers now pay £1,380 less annually than they would have done at the time of the General Election.

If mortgage rates continue to fall by a further 0.5 percentage points over the next year, the estimated annual saving could rise to £1,720.

Interest rates on fixed-term mortgages increased sharply in October 2022, peaking above six per cent following market uncertainty. Since then, rates have gradually eased, influenced by inflation trends, improved economic forecasts and changes to the Bank of England’s base rate.

Elsie Blundell, MP for Heywood and Middleton North, said the latest figures will come as welcome news to families facing higher living costs. She added that the fall in mortgage rates was “real money in the pockets of families” and pointed to the importance of long-term economic stability.

Mortgage rate data comes from the Bank of England. The figures reflect new borrowing only and may not apply to those currently locked into higher fixed-rate deals agreed before rates fell.

The mortgage news comes as changes to rental law are also expected to take effect later this year. The Renters’ Rights Act, due to begin on 1 May 2026, will introduce several reforms including a ban on no-fault evictions and tighter controls on rent increases.

Separately, the government has also announced other measures aimed at reducing living costs. These include a planned reduction in energy bills, a freeze on rail fares, and adjustments to the minimum wage.

Conservatives select Emma Lee as candidate for Tottington by election

Conservatives select Emma Lee as candidate for Tottington by election

Bowlee car boot sale returns for the 2026 season

Bowlee car boot sale returns for the 2026 season

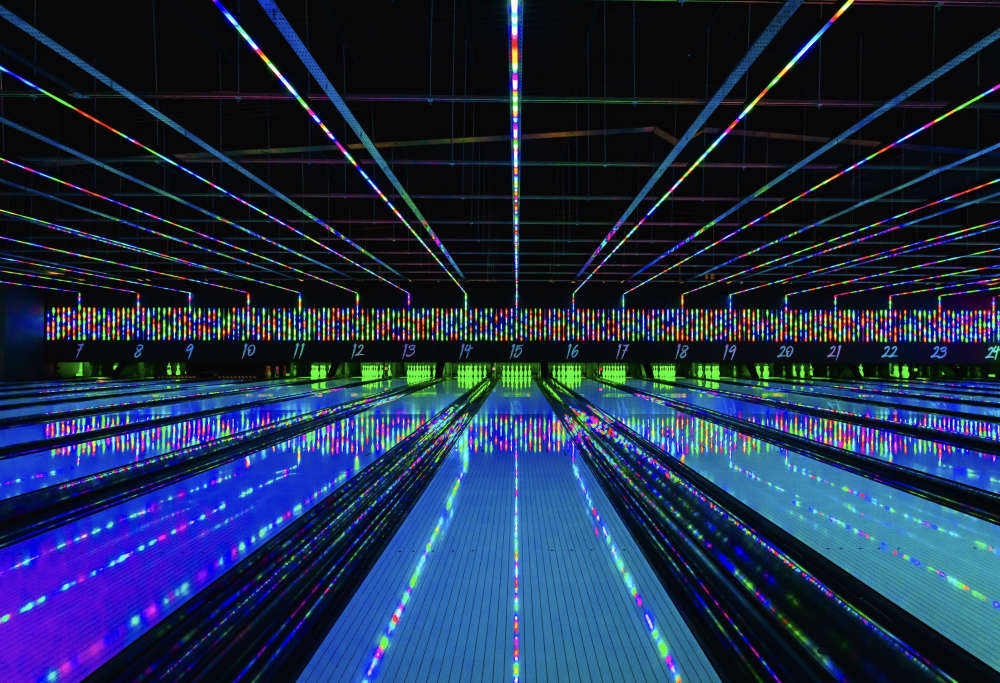

Inside the major refurbishment transforming Tenpin Rochdale

Inside the major refurbishment transforming Tenpin Rochdale

Former Middleton pub could reopen as convenience store after closure

Former Middleton pub could reopen as convenience store after closure

Councillors raise concern over Riverside Housing sale of social homes in Middleton

Councillors raise concern over Riverside Housing sale of social homes in Middleton

Heywood community raises £1799.65 as Donna Dolan shaves hair for Macmillan

Heywood community raises £1799.65 as Donna Dolan shaves hair for Macmillan

Road closure in Ramsbottom

Road closure in Ramsbottom

Rochdale families urged to shape national consultation on keeping children safe online

Rochdale families urged to shape national consultation on keeping children safe online

Civil war erupts as Labour activists in Gorton and Denton say party is ‘not willing to change’

Civil war erupts as Labour activists in Gorton and Denton say party is ‘not willing to change’

Silver Street offices approved as temporary housing

Silver Street offices approved as temporary housing

All the major projects Rochdale can expect from capital funding

All the major projects Rochdale can expect from capital funding

Emergency services respond after people report illness at Bury premises

Emergency services respond after people report illness at Bury premises

Comments

Add a comment