The last bank in Middleton will soon close its doors, leaving locals feeling ‘disgusted’.

The Halifax branch in Middleton Gardens was the last holdout, but after years in the town it will close on January 8, 2026. This comes just months after the Natwest on Long Street decided to pack up.

It marks the end of an era for in-person banking for the Greater Manchester town.

Anita McCormack has been in Middleton for decades. Stopping on her way to do some shopping, the pensioner explained how this closure will leave many of the elderly feeling isolated.

“I think it’s disgusting it’s closed,” the 74-year-old explained. “Barclays closed a couple of years ago. They say you can do online banking, but what about those who can’t do technology, especially older people.

“I think it’s dreadful, they tell me I should do it online, but I want to speak to a person, not a robot. I just think it’s more social for a lot of people. Those older than me probably don’t speak to people some days.

“Not everyone is technically minded. But everything is going the same way, everything is closing and going online.

“It’s the end of an era for the town centre. They’re taking these things from the older generation, it’s not right.”

Customers changing the way in which they do their banking is cited as the main reason for the closure of the Middleton Gardens branch.

A review into the decision from Halifax went on to say the Oldham branch remains open and a banking hub in Heywood is also available for customers.

Beatrice Lowe, taking a break on a bench in the centre of Middleton before heading back to Bowlee Carpets shop, told the Local Democracy Reporting Service: “I think it’s just disgusting. Where are we going next, they’re only thinking of the young people.

“I can’t use the internet or tech. I’ve been with NatWest but it closed in April.

“I go to Tesco to sort a few banking bits. If I need to do something more technical I don’t know what I’d do. I’d have to go to Oldham.

“The physical bank, if you’ve got a problem you can discuss it with them. But now you can’t.”

The 82-year-old rubbished Halifax’s reasoning of fewer people banking in person for the closure.

She added:

“It’s terrible all the banks are going. The world is changing completely. It’s part of the decline of the town centres.

“NatWest, before it closed, the queues in there were ridiculous. So it’s nothing to do with footfall, it’s because they don’t want to pay as much on staff.”

One woman who just stepped out of the Halifax destined for closure chipped in saying: “I don’t use it very often as my son does it for me. So I don’t think it’ll impact me too much.

“The thing is, they all use cards and machines. I would prefer it if it stayed open, but that’s life, there is nothing I can do about it.

“They’re forgetting the elderly, they’re not interested in them as we’re not spending as much as they used to.”

This trend of closing banks has been going on for years, with many due to put the shutters down even earlier than Halifax’s Middleton branch. Major banks, including Lloyds, NatWest, Halifax, Santander, and Barclays, have announced branch closures that will take effect in November.

In total, 24 banks are due to shutter in November, with Lloyds leading the way. Sixteen of the closures this month affect Lloyds branches, including in Manchester’s Newton Heath.

Banks will disappear from high streets across every region of England, as well as Scotland and Wales. By the end of 2025, more than 500 banks will have shut, according to recent data.

Paul Warrington paused reading his paper to share his thoughts on the decline of banks in his home town. He fears the damage this could cause with online fraud and scammers posing a huge threat to people’s hard-earned cash.

The 51-year-old said:

“It’s Middleton falling apart. It’s not just the banks, it’s everything that was in the past has just gone.

“I’ve been here for 50 years. My parents bank at Halifax, but I have to walk to Rochdale. My parents are in their 70s. They can’t do online banking, they can just about send a text or an email.

“Everything seems to be online now. If you’re older and can’t do that, you seem to be shoved to one side.

“It’s becoming a ghost town in Middleton. There is only Tesco to do the weekly shop, it’s just rubbish. There are no options anymore.

“There is fear of online fraud as well now so people prefer going in person. I think the scams and fraud is losing trust in online banking so many are going back to in-person banking.

“It’s dangerous, I wouldn’t do online banking if my life depended on it. If you talk to a person you get an honest answer.

“The way things are going, we’re being pushed into a corner where we have no say in the matter.”

There is still a post office in Middleton where residents can withdraw cash and access some banking services, but the general consensus amongst locals is one of frustration.

No more banks means they would have to travel to Rochdale, Oldham, Manchester or even further afield for a physical bank.

For those less mobile or without access to a car, this would be a huge issue. However, a pop-up Barclays local is still available to locals, three days a week, at the Lighthouse Project Community Hub within Middleton Shopping Centre.

A Halifax spokesperson:

“The way people are banking has changed, as more than ever, customers are choosing to manage their money through our app. The local Post Office and Banking Hub offer everyday banking, with cash also available at nearby free-to-use ATMs.

“Customers can also manage their money on our app, online or by calling us.”

Halifax went on to say that they are contacting customers to let them know about the alternate local banking services available.

Conservatives select Emma Lee as candidate for Tottington by election

Conservatives select Emma Lee as candidate for Tottington by election

Bowlee car boot sale returns for the 2026 season

Bowlee car boot sale returns for the 2026 season

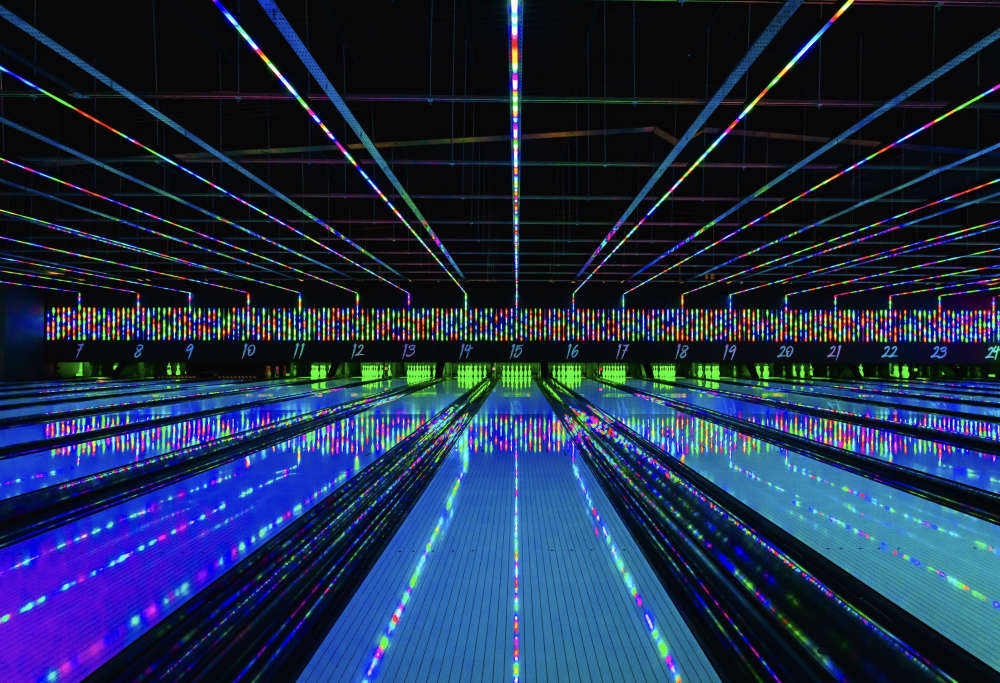

Inside the major refurbishment transforming Tenpin Rochdale

Inside the major refurbishment transforming Tenpin Rochdale

Former Middleton pub could reopen as convenience store after closure

Former Middleton pub could reopen as convenience store after closure

Councillors raise concern over Riverside Housing sale of social homes in Middleton

Councillors raise concern over Riverside Housing sale of social homes in Middleton

Heywood community raises £1799.65 as Donna Dolan shaves hair for Macmillan

Heywood community raises £1799.65 as Donna Dolan shaves hair for Macmillan

Road closure in Ramsbottom

Road closure in Ramsbottom

Rochdale families urged to shape national consultation on keeping children safe online

Rochdale families urged to shape national consultation on keeping children safe online

Civil war erupts as Labour activists in Gorton and Denton say party is ‘not willing to change’

Civil war erupts as Labour activists in Gorton and Denton say party is ‘not willing to change’

Silver Street offices approved as temporary housing

Silver Street offices approved as temporary housing

All the major projects Rochdale can expect from capital funding

All the major projects Rochdale can expect from capital funding

Emergency services respond after people report illness at Bury premises

Emergency services respond after people report illness at Bury premises

Comments

Add a comment